Virtual cards: main advantages

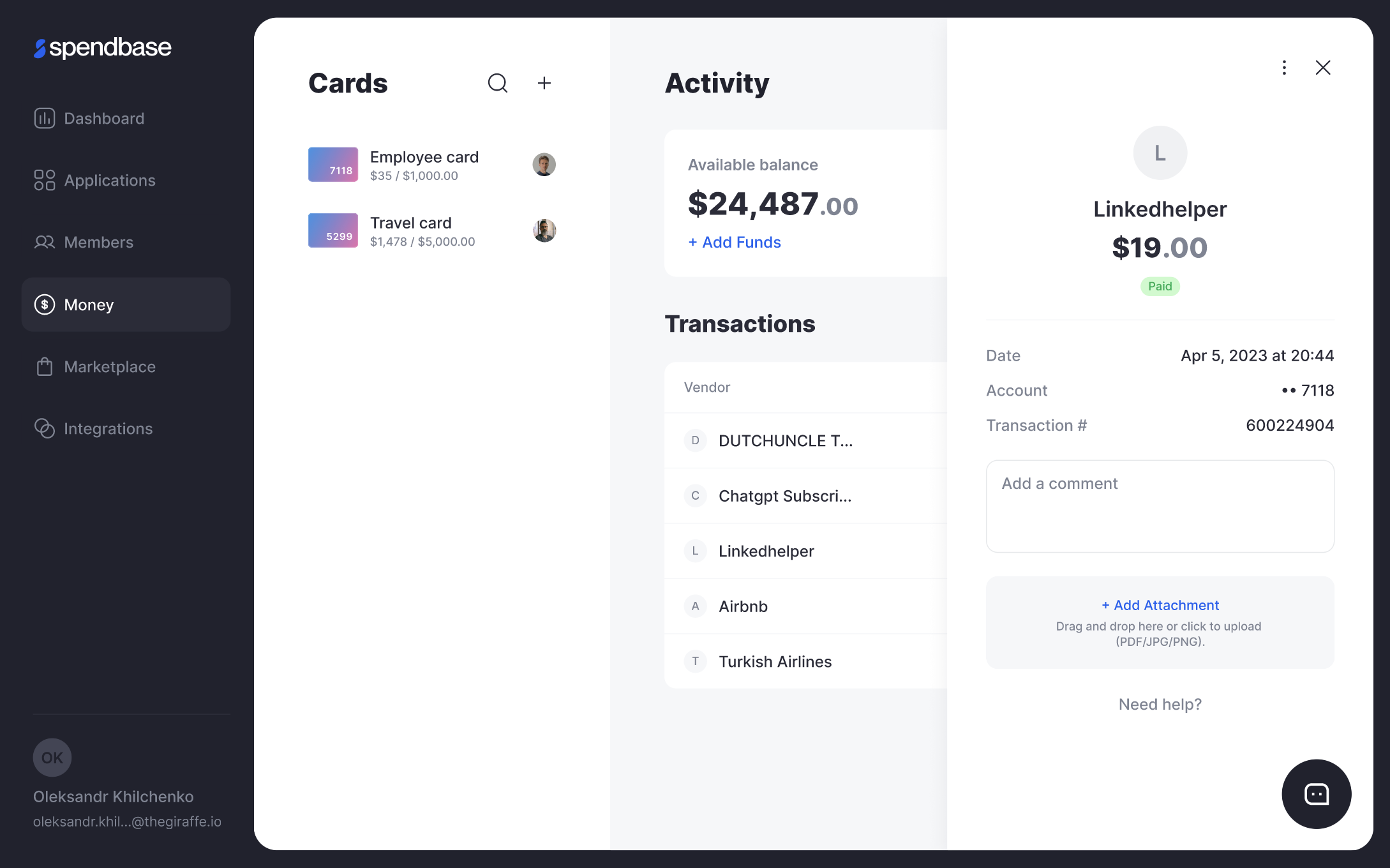

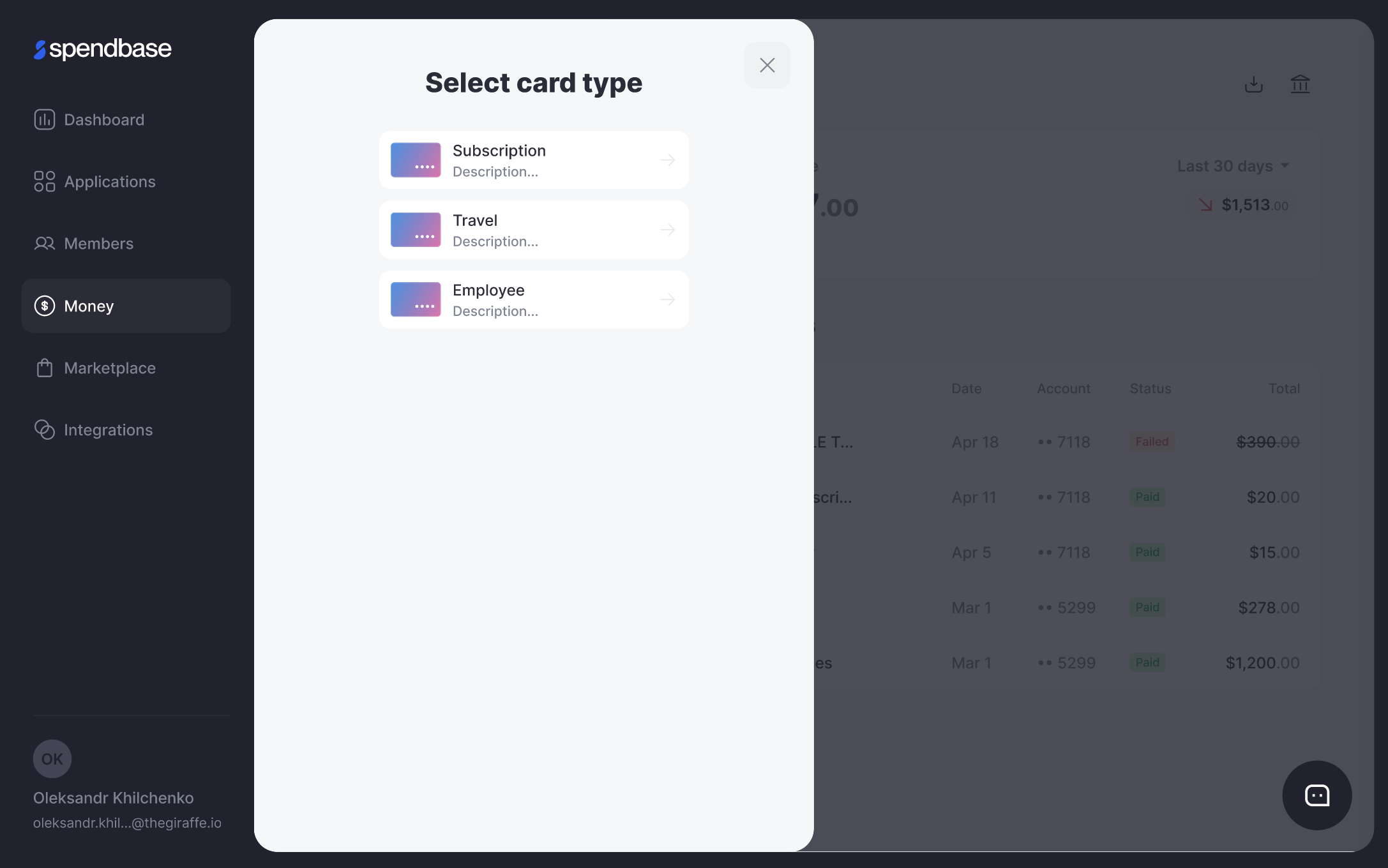

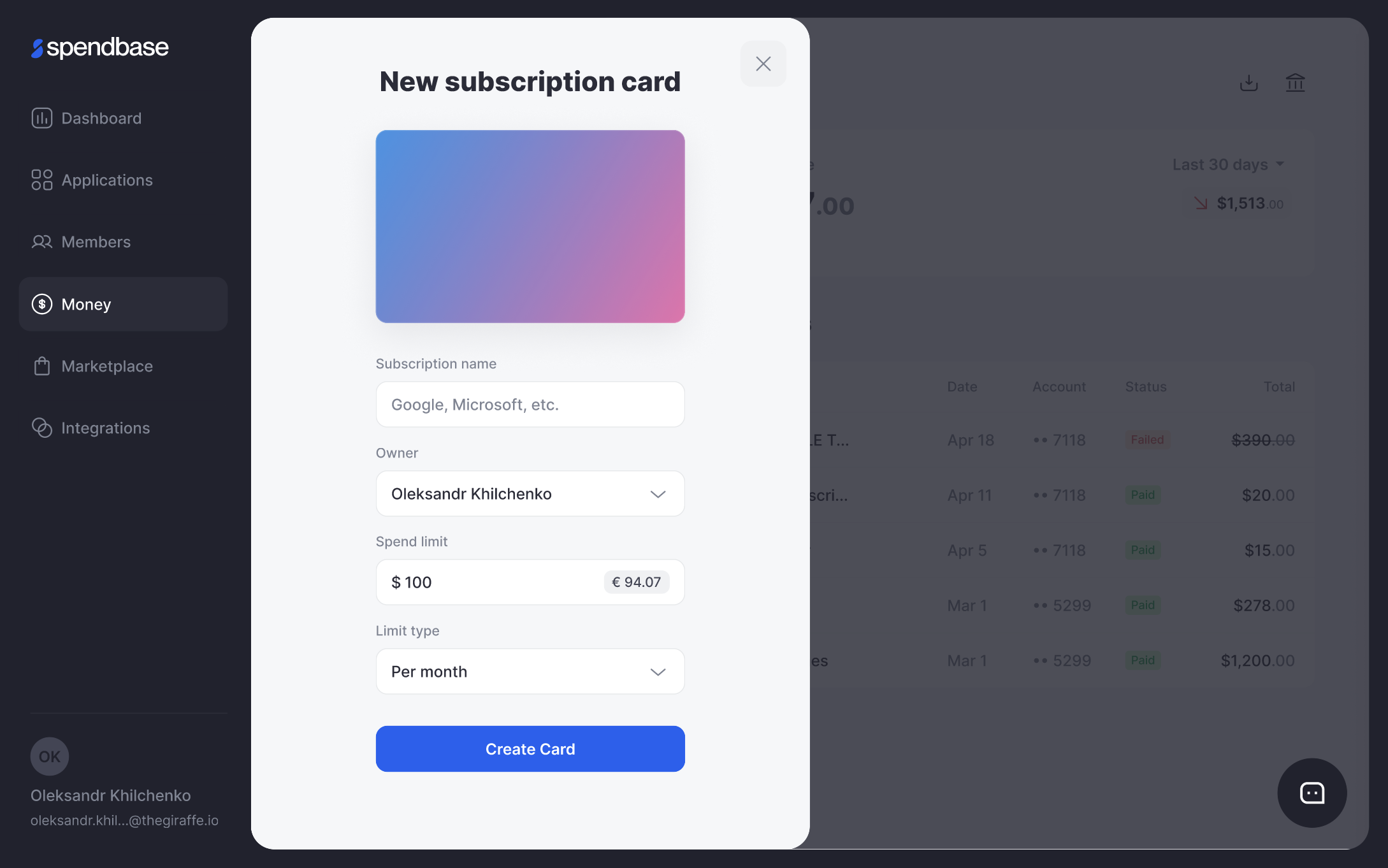

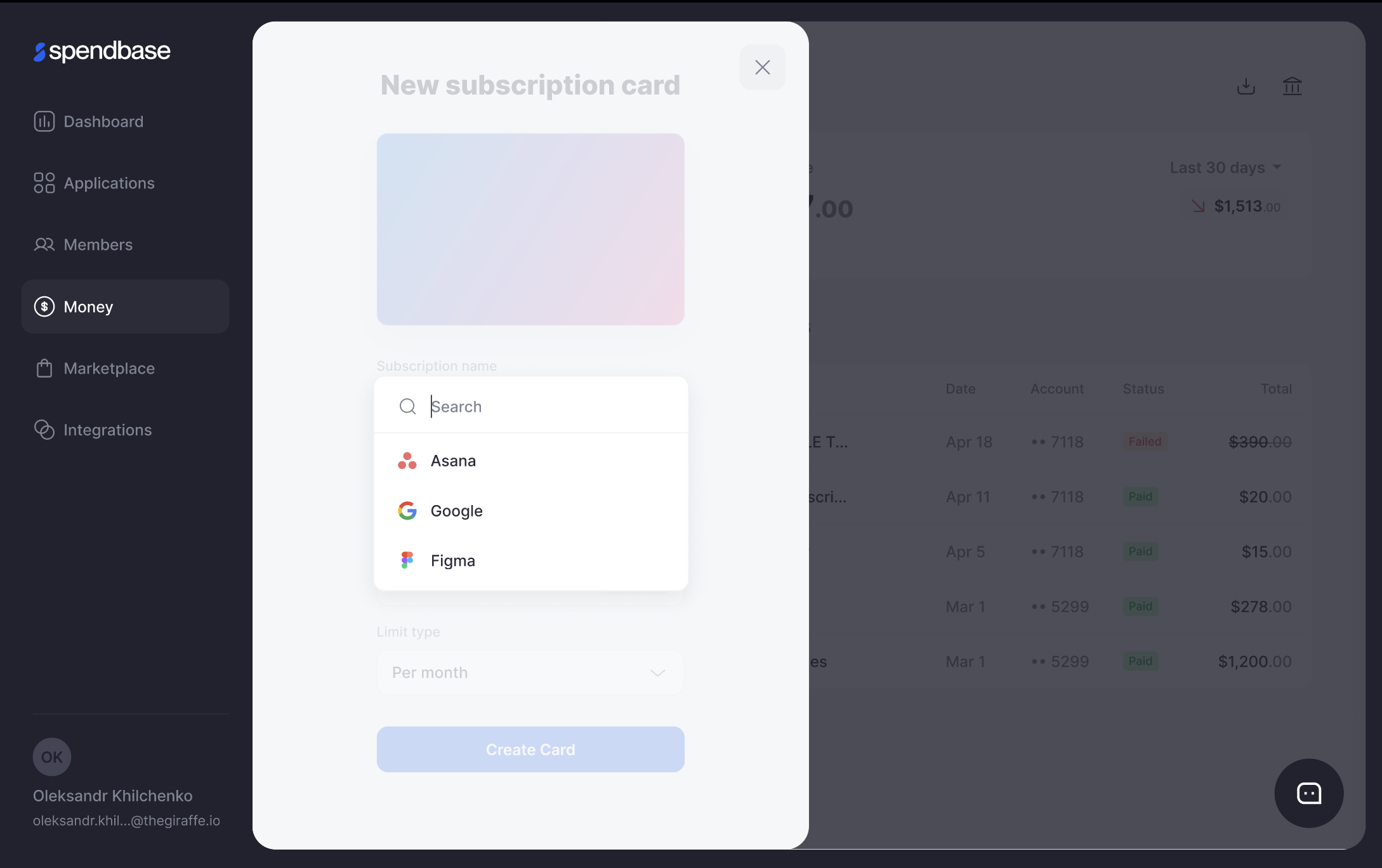

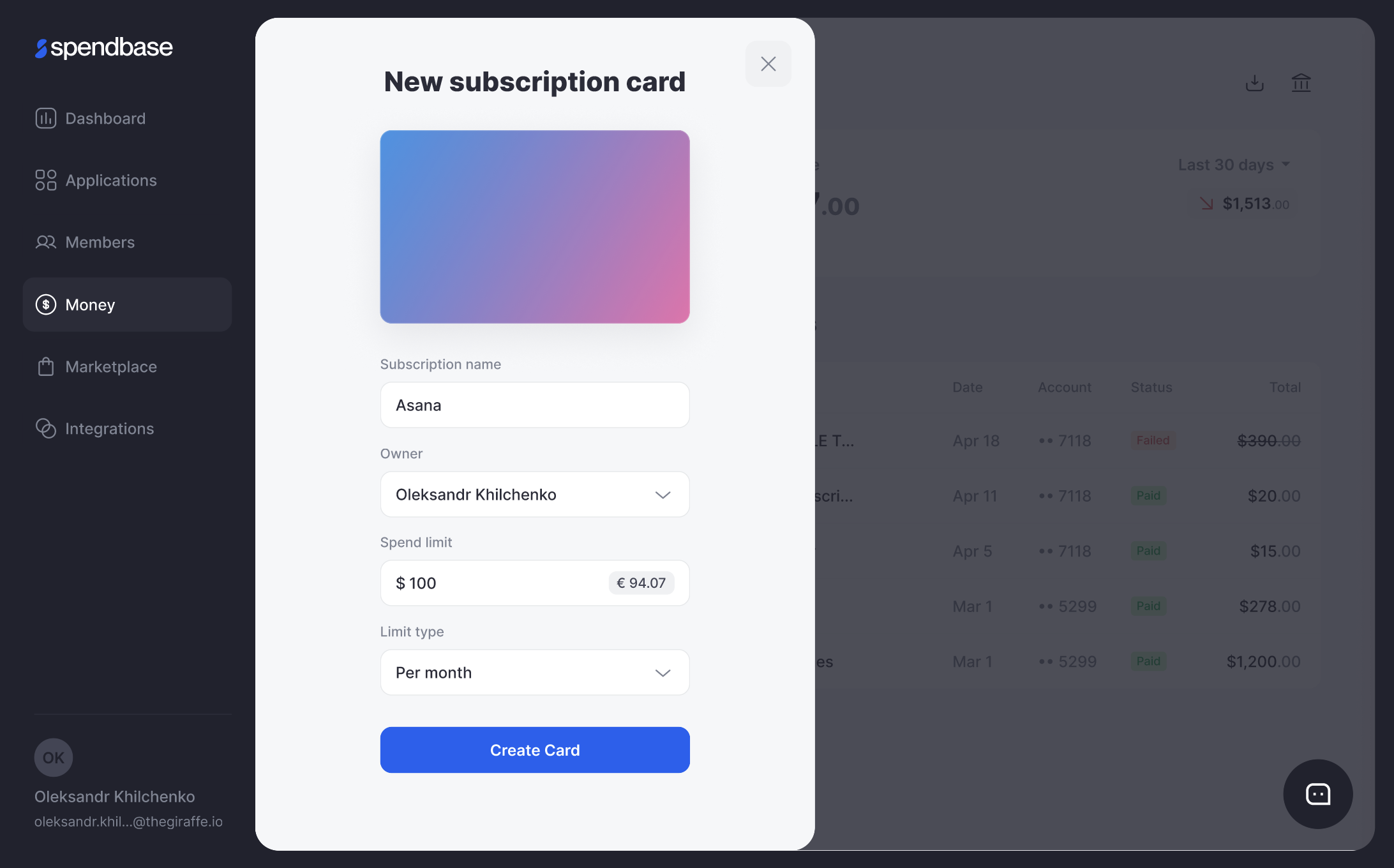

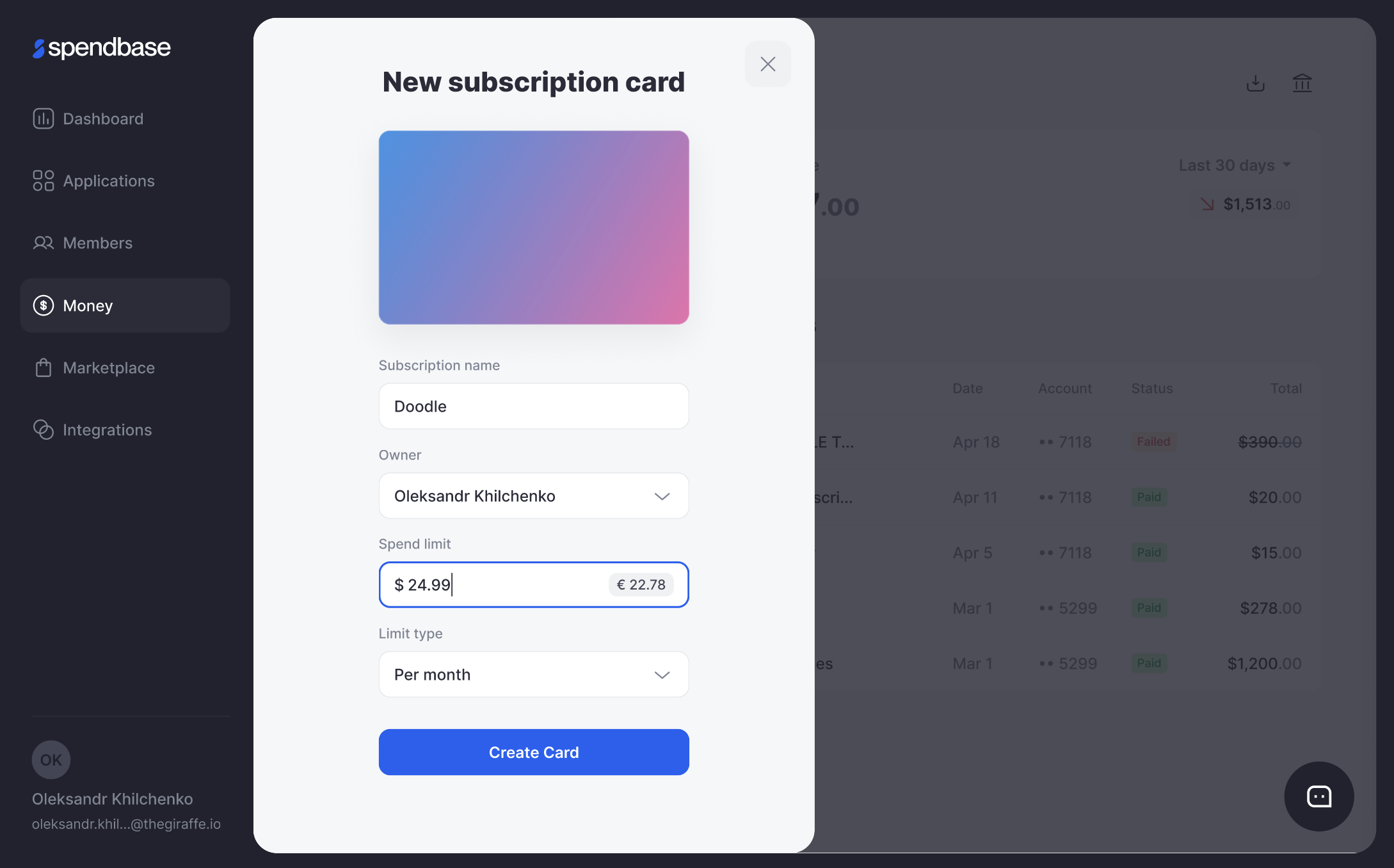

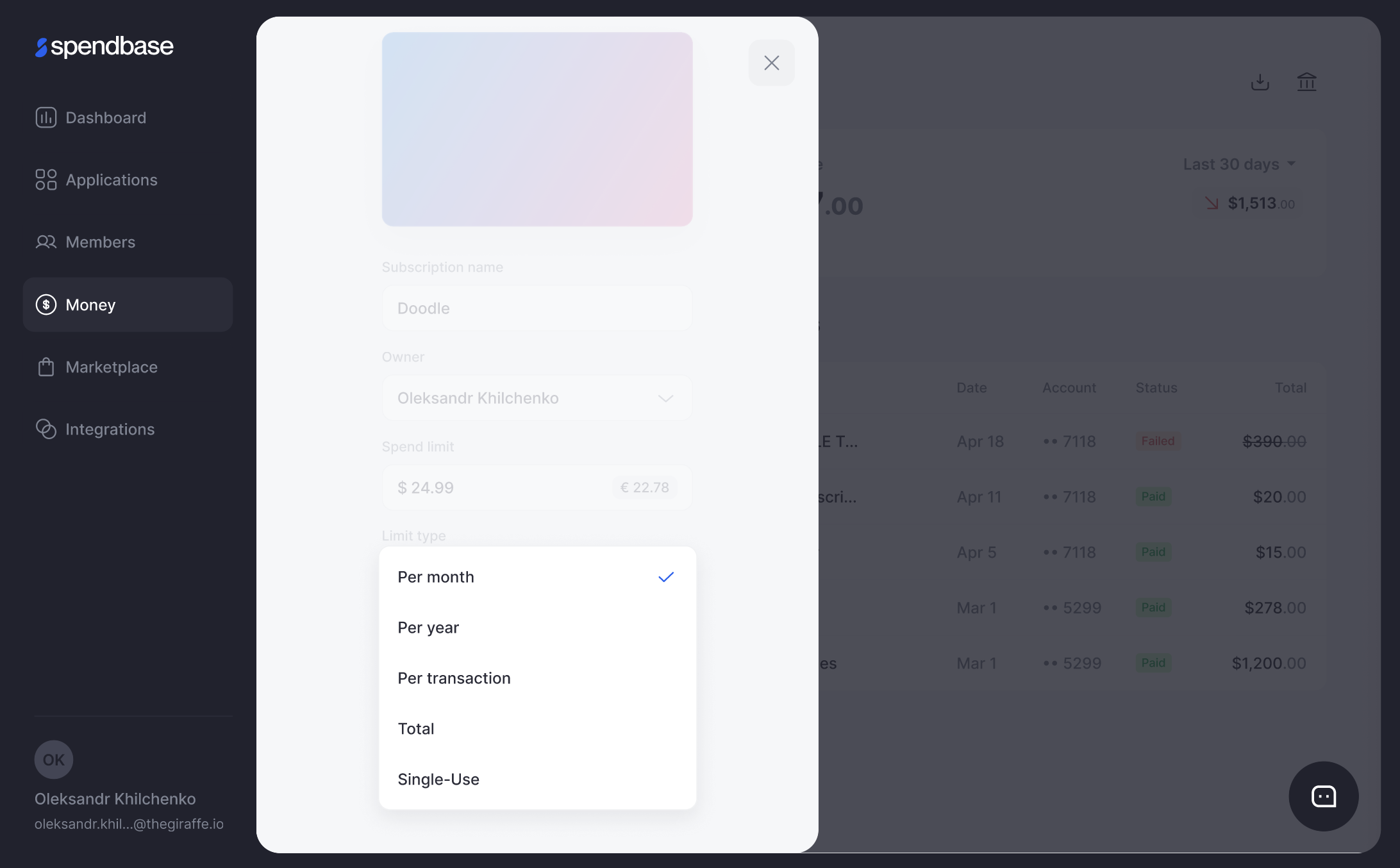

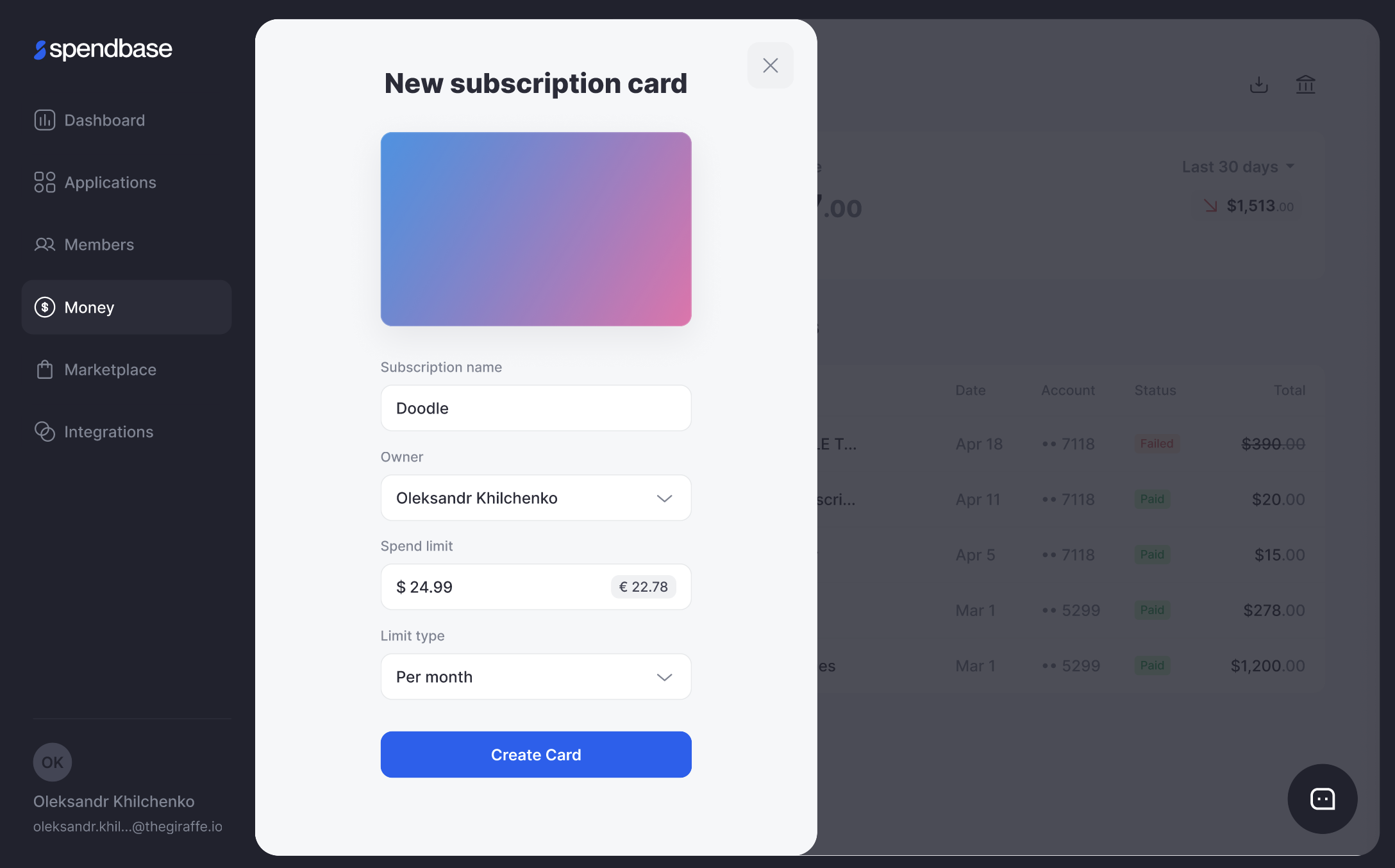

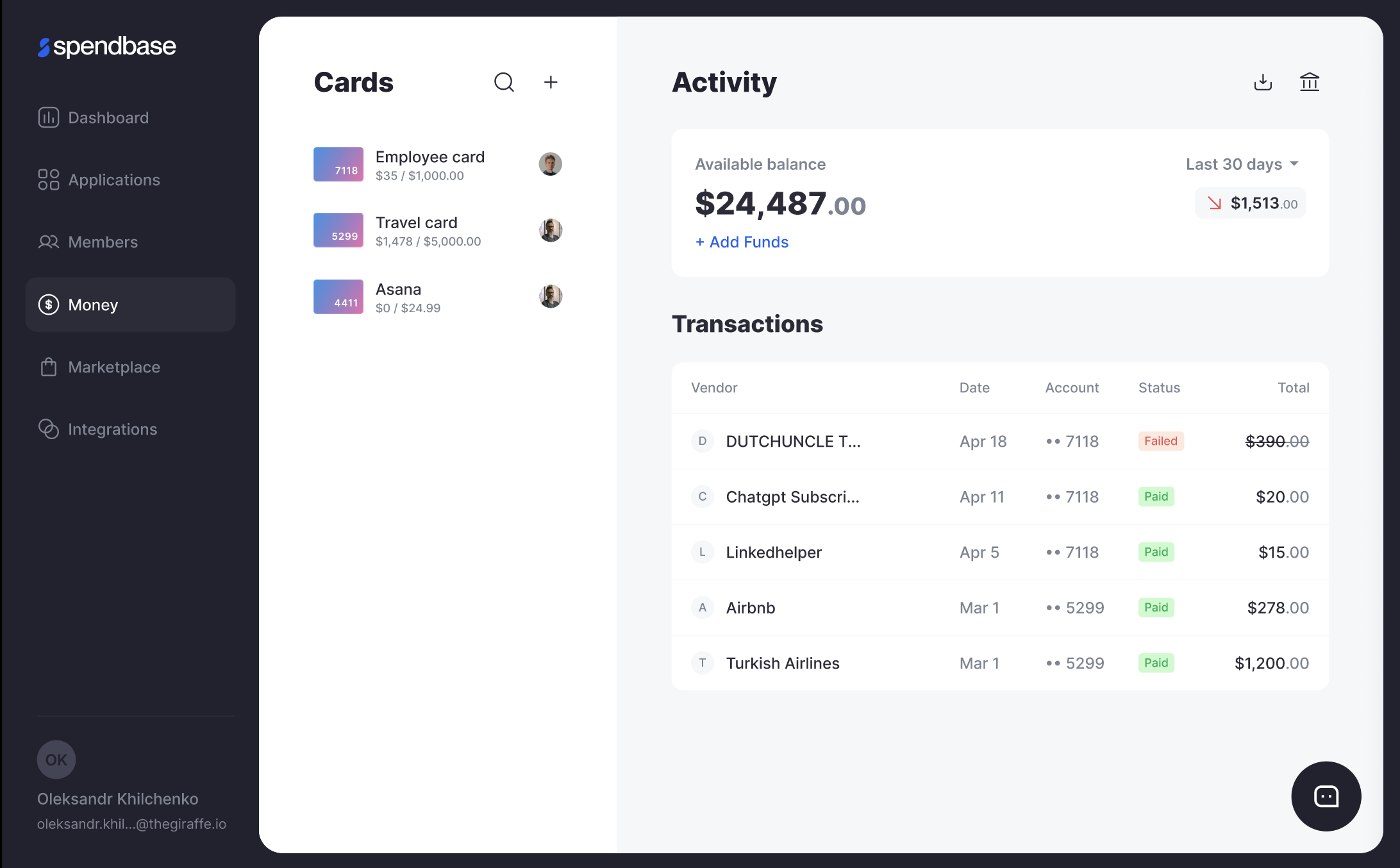

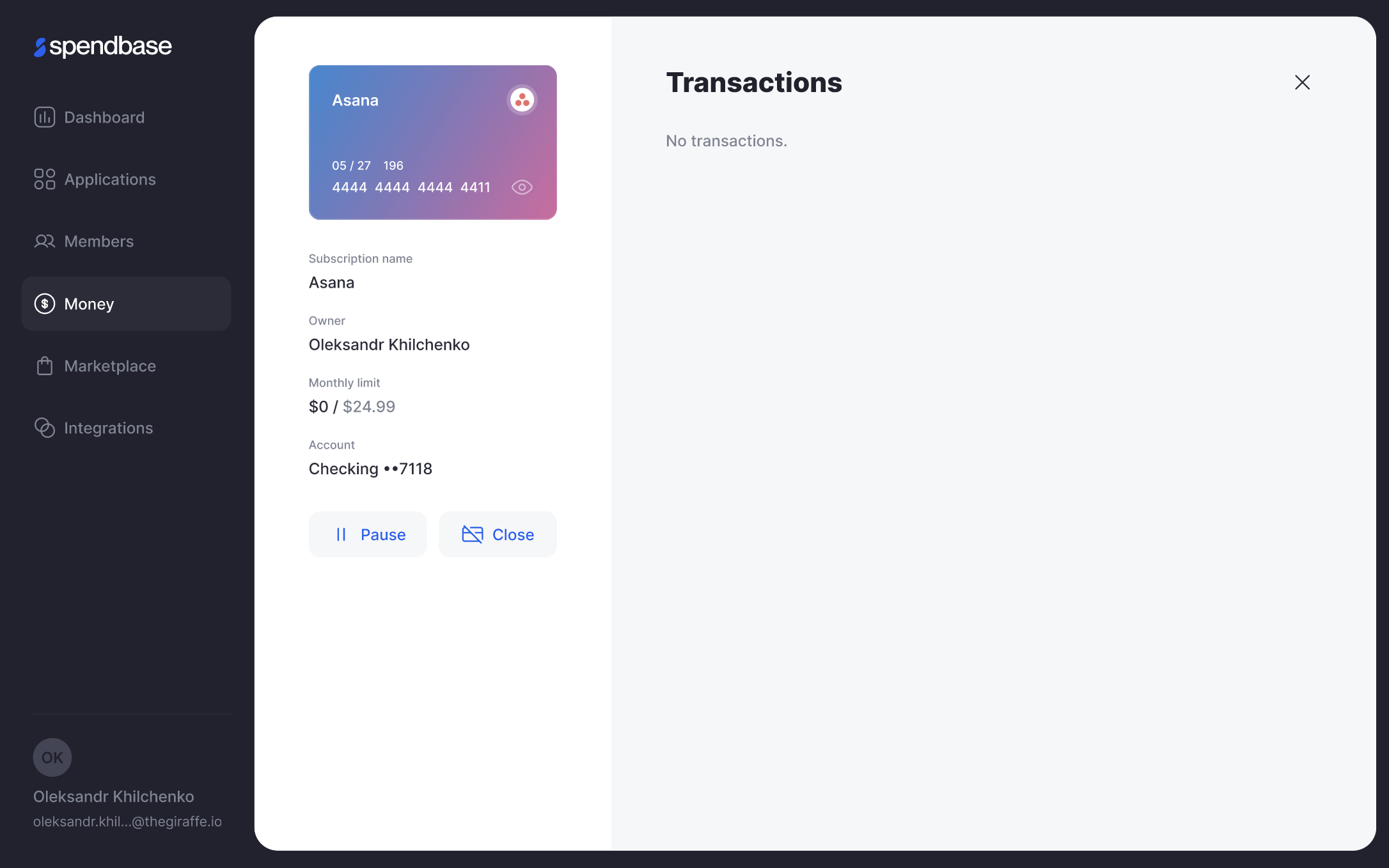

- The ability to create a virtual card for any service with a spending limit on them. This creates an additional level of protection for our customers, as funds allocated for a specific product, for example, Asana, can only be debited for Asana payments within the set limit.

- CEOs and Owners will be able to unlink their cards and company accounts to payments for services or one-time purchases from different departments, which saves time and eliminates the need to confirm such transactions manually.

- The ability to use cards for trial services eliminates the need to tie up a personal card and at the same time protects against the sudden withdrawal of funds if the subscription is forgotten after the trial period. It will save you money if you forgot to cancel the subscription.

- Using virtual cards for business trips and conferences makes it easier to monitor expenses during trips and events eliminating the need to allocate/refund funds directly to the employee. Cards can also be issued for each employee if you provide them with benefits such as taxis and lunches, just put the daily limit for such operations.

- The ability to receive cashback as an advantage over similar products in the US market; the ability to distribute our product free of charge as an advantage in the European market.

- In the near future, we will implement automatic uploading of invoices. ( for now, it is manual)

- The possibility of adding cards to Apple Pay and Google Pay.

.png?height=120&name=dark=on%20(1).png)